Although I have bought Savings Bonds a few times, I have never bought Treasury Bills or Treasury Bonds before. The bills are short-term notes of 1 year or less (4, 8, 13, 17, 26, and 52 weeks being the most common). Treasury Bonds are long term: 10 or 20 years. Treasury Notes are in between (2, 3, 5, 7, or 10 years, with the 10 year note being the one that commercial mortgage rates are based on). Usually the yield on the bills has been so low it isn’t really worth bothering with. I could get about as much with a CD or money market. I have a savings account right now earning 3%. Nothing can compare to the Series I Savings bonds I have which are getting 9.6% interest at the moment, but I have maxed out my purchases for the year on those and they hold your money for at least 1 year and penalize you 3 months interest if you cash them in before 5 years, plus the rate changes every 6 months, and it will be less soon. I had a lot in some short-term corporate bund funds, but because interest rates are still going up, I have lost money on those: their share price has dropped about 4% and they still only yield about 2% in dividends.

Dad used to talk about buying Treasuries, but I don’t know if he ever did. It always seemed complicated. But I had to open an account at Treasury Direct when I bought the Series I savings bonds and they actually make it pretty easy to buy other kinds of government debt. At the last auction for 26-week bills, the interest was 4.55%, the same as for the 52-week bonds sold the same day. The rates are set in weekly competitive auctions where the government is financing billions of dollars of debt. But ordinary people can invest from $100 up to $10 million in a non-competitive order where you just accept whatever the competitive rate comes out to be. The bills are sold at a discount and mature at full value. So a 52-week $1,000 bond would sell for 4.55% less than that and the government would pay you $1,000 at maturity (or you can opt to roll it over into the next auction). I looked at yields of the different durations and it seems like the best rates are 26 to 52 weeks right now. Longer term rates are lower because people don’t think these high rates will last that long. And short term rates are lower because they just usually are (less risk). In fact the yield curve of those different durations is kind of messed up right now, which many people say means a recession is coming.

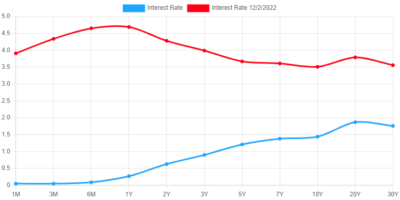

I pulled this graph of the yield curve from www.ustreasuryyieldcurve.com. It isn’t that the long term rates have gone down as interest rates have risen, but the shorter term rates have risen much faster than the long term rates. A year ago the 26-week rate was 0.2% and the 30-year rate was 1.9%. Now the 26-week rate is 4.6% and the 30-year rate is 3.6%.

The next deadline to enter a 26-week auction was tomorrow, December 5, so I went ahead and transferred money from my savings account to checking and told Treasury Direct to put me down for a non-competitive purchase. They said the bonds would actually be issued on December 8 and mature on June 8, so we will see how that goes. Some people ladder their bonds by buying some every month, so that you constantly have money coming in if you need it. I also plan on buying more I bonds once we get to 2023.

The auction took place today. Rates were higher than last week’s auction (and will keep going up, I suppose). Treasury posts two numbers for the results, a “high” rate of 4.570% and an “investment” rate of 4.743%. I guess the investment rate is compounded at 6 months? It doesn’t quite calculate out the way I would think, but Treasury has their own way of doing math. The discount value is 97.689611 so to get paid $100 in six months you would have to pay $97.689611 now. They have a minimum bid of $100 and increments of $100, but the actual purchase price would be $97.69 even if you put in an order for $100. If I calculated the interest, I would take the ending amount and divide it by the purchase price. Since it is a 26 week bond, the easy way would be to double that resultant for an APR which would be 4.730%. But I would compound it by squaring the result of the division which would be 4.786%. Neither number matches Treasury’s investment rate.

I wondered if I could buy treasuries via Vanguard or Fidelity and of course you can. I didn’t have as much cash sitting around at Fidelity, so I looked at Vanguard and saw that I could buy an 8-week treasury that should have about a 4% APR, so I tried that. Apparently Vanguard doesn’t charge a commission for purchases of treasuries. That auction is Thursday. That was interesting since I had never tried to buy an actual bond before, just stocks, mutual funds, and ETF’s.

Today they took the money out for the first bond I bought, which was a multiple of $99.689611, which I eventually figured out.

Also the auction for the 8-week bond I bought is done and the price was $99.387111, which is a yield of 0.616669% (100 divided by 99.387111). I can multiply that by 365 days per year divided by the 56 day term and get an annual yield of 4.019% which is what they give as the investment rate, so maybe I am onto something. That is a little less than last week’s result of 4.163%. In terms of dollars earned it isn’t very much, but it is more than my savings account rate of 3% and more than the most recent yield of my short term corporate bond fund of 2.4%.

Using that formula and applying it to the first bond (a 26-week bond, so 182 days), I again get the stated investment rate, so this is a good formula for the investment rate: R = ((100/P)-1)*(365/T) where P is the discount price and T is the number of days of the bond. Edit: change 365 to 366 if there will be a leap day in the next year, starting with March of the year before the leap year.

The day after the auction, Vanguard now shows the bond as one of my holdings. They charged me exactly what they should have down to the penny despite showing the single share price to only two decimal places in the order status. To make it more confusing, if you buy $100 worth of bonds, they show you have 100 units. But the unit price is shown as $99.90 (or whatever the price is), which makes it seem like you have 100 x $99.90 or $9990. But you don’t. However, I guess the yields on that issue were a little depressed and the market has already moved back up because Vanguard shows the market price of the bond and I am losing $1.36! The bond price doesn’t matter if you hold it until maturity, but it is still interesting that they keep up with it and that I am losing money. Now I have a 8-week and 26-week bond. There is an auction for 13-week bonds Monday if I want to add another rung to my ladder . . .

I added two more rungs to my ladder with a 13-week bond on Monday and a 17-week bond today. That gives me 4 bonds total maturing in February (8-week 4.019% APR), March (13-week 4.377%), April (17-week 4.569%), and June (26-week 4.743%). Then each month as those mature I can get a 26-week bond, or do something else. I probably won’t but I could fill in the May rung with another 17-week bond next month.

I filled out my ladder and now have bonds maturing in each of the next 6 months. I had some money in Vanguard’s Tax Exempt Bond ETF, but it was only yielding about 2% and was subject to price changes based on interest rate moves, so I went ahead and sold that to buy some more T bills. Even the Vanguard money market fund that the cash from the sale of the ETF sits in is earning 4.23% with no risk at all (albeit taxable, though the tax isn’t 50%). Interest rates are still rising, so the 26-week bill that matures in July will get 4.9% while the 17-week bill I bought today, maturing in May has an APR of 4.8%. Meanwhile inflation has been very flat since June, so I may hold off on getting an I bond until April when the next inflation rate will be known (currently the inflation portion is 6.48%).

A T-Bill I bought matured yesterday. It was just an 8-week bond I had bought in December, but I wondered how it would work since this is the first one I had that matured. This one was bought through Vanguard who doesn’t do a great job of keeping up with bonds. So nothing showed up yesterday, the day it was maturing, and it just continued to show as one of my holdings. Then this morning, it showed me getting my original purchase price back, then on another line it showed the interest earned. Meanwhile, knowing that bond was about to mature I bought a new 26-week bond at the auction on Monday, knowing the money wouldn’t be taken out until today. It’s a little tricky since you can’t sign up to buy a bond until it is advertised and it is only advertised a couple of days in advance (you can see the schedule, so you still know what is coming). It worked out and I had enough money to cover it if I didn’t get the cash from the old bond in time to pay for the new bond, but I think that was probably too close. The most recent 26-week bond APR was 4.92%, so the rates are still going up for now. However, with the debt ceiling reached and cooperation in Washington at a standstill I wonder if debt payments will be in jeopardy.

I bought another T-bill in March. I have been using the formula in my December 8 comment above and it has always matched Treasury’s investment yield perfectly. But this time it did not. I tried to find the error and decided maybe Treasury was just wrong and I should write to them and tell them. However, part of my formula uses 365 days in a year. And now that we are past February, the next February (in 2024) will have 29 days. So the formula changed to represent a 366 day year even though the bond itself will have matured before we ever get to leap day. The bank crisis made rates go down a little, but they are still pretty good. One of my bonds matures this month, so I will probably take that money and buy another 26-week bill.

I have been rolling over maturing T-bills in my ladder to new 6-month T-bills. Right now the yield is about 5.5%, which is great, but also means the government is paying about 3 times as much in interest as 2 years ago. My cash in my Vanguard account is in a money market mutual fund and that is earning 5.3%, so really the whole bond laddering thing isn’t making me much compared to that. In fact, by the time any of my 6-month T-bills has matured, Vanguard’s rate is always higher than the rate of the expiring T-bill. The T-bill always starts higher, so maybe I am making a little bit, but I doubt it is worth the effort.

I have continued to roll over treasury bills. The rate peaked a couple of months ago at around 5.6%, but is only down to 5.4%. I bought some of the bill through the government’s Treasury Direct, but most through Vanguard. One problem was I never knew if the money for the new bond would be taken out before I got the money for the maturing bond, so I needed to cover the price in whichever account was being used. For Treasury Direct that meant I had to have money in my savings account and move it over to checking. Capital One is very quick about crediting incoming deposits, so I think it would have worked fine, but I never wanted to risk it. Then I realized I can go to Treasury Direct and ask them to repurchase a maturing bond. They should then take the maturing bond value, say $1,000 and then subtract the price of the new bond, today it is $973.76, and then transfer the difference ($26.23) back to my bank account. I knew they allowed reinvestments, but I wasn’t sure you could change it after you bought the bond. This works out a lot better. Vanguard might let me do something similar, though it is not as important there since I always have enough money there to cover the purchase price.