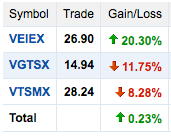

As the economy started coming back, some of our stocks started to turn green in the Fall. Most of our savings are in stock indexes, though. We have three Vanguard stock index funds recommended by Clark Howard. While only one of them has turned green, it turned green enough to make the entire portfolio green today. So…. back to where we started.

I have two of those: VEIEX and VGTSX. You’re doubling down on emerging markets by having both (15-25% of VGTSX is in emerging markets), but VEIEX was amazing last year (I bought it in December 2008 at 14.51, so it is up 80%). I bought some VGTSX in 2007 at 17.66, so it is still losing money.

There’s a sobering article by Bill Gross, founder of PIMCO (huge bond fund), on the U.S. debt and why asset values might be bound for a fall.

http://is.gd/68AFm

The reasoning is that “quantitative easing” in the form of the Fed buying U.S. government securities amounts to a much huger government stimulus than was widely discussed, that stimulus was 2009-specific, and it’s a great explanation for the upturn in 2009.

It’s a dense article, and you have to sift through his offhanded humor, but he says something particularly interesting at the end. It’s quoted below. I had only thought about a “carry trade” in currencies, but he mentions two other kinds.

Additionally, if exit strategies proceed as planned, all U.S. and U.K. asset markets may suffer from the absence of the near $2 trillion of government checks written in 2009. It seems no coincidence that stocks, high yield bonds, and other risk assets have thrived since early March, just as this “juice” was being squeezed into financial markets. If so, then most “carry” trades in credit, duration, and currency space may be at risk in the first half of 2010 as the markets readjust to the absence of their “sugar daddy.”

The Fed made $45 billion last year by providing stimulus (in today’s news). Those were realized profits, not just an increase in value of their assets because this was money they actually turned over to the government. Interest rates have risen a little bit, but not much considering how much borrowing the government has been doing. The Fed jumped in at the bottom and bought US bonds on the cheap and their value has gone up since then. Meanwhile they have been able to sell some of it at a profit. They may be able to do the same with a lot of the mortgage securities they bought since they bought them when the market was low and uncertainty was very high. The government has to stop borrowing so much at some point, but so far the damage caused by the borrowing has been pretty minimal.