I wrote about how to possibly buy gold ten years ago. Since then, it has gotten a lot easier and also much more expensive. There are now exchange traded funds that invest in gold, introduced in 2007. The biggest gold ETF has ticker symbol GLD. It has $32 billion in assets, all of which is invested in 400-ounce bricks of gold bullion: 804 tons! You buy the shares just like you buy shares of stock. The costs are minimized and the money is invested directly in gold, not gold-related stocks like mining companies which is how many mutual funds invest in gold. Even with operating expenses of 0.4% per year at GLD (0.25% for the similar IAU), if you’re serious about investing in gold, an ETF is a pretty good way to do it. One caveat is that capital gains on gold (considered a “collectible” by the IRS) are taxed at 28% for long term gains. One way around that would be to use money in your IRA to buy shares of a gold ETF, then when you sell it, you wouldn’t pay taxes on any gains. This doesn’t work for gold bullion. If you have gold bullion in an IRA and sell it for a profit, you will owe tax that year, but this doesn’t apply to a lot of ETF’s even if they invest in gold bricks like GLD or IAU. My Fidelity Roth IRA account is also a brokerage account, so I can invest in GLD, SLV, or IAU. Fidelity offers commission-free trades for some iShares ETF’s, but not iShares precious metals ETF’s SLV and IAU. In fact, Fidelity will even let me buy bullion for my IRA through Fidelitrade (a separate company, apparently), but there are a lot of fees per transaction and for storage. You also have to be careful about buying physical gold in an IRA because not all gold is eligible (Kruggerands are not eligible because they are not pure 24 karat gold, but American Eagles are despite not being pure gold).

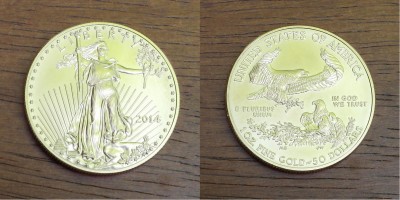

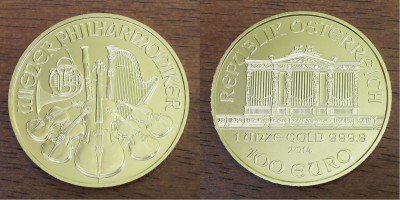

But there is something about actually being able to touch what you are buying. For that you need to buy actual gold, which is much less efficient. The gold trading website, Bullion Direct, and its online market, Nucleo Exchange, that I wrote about in 2004, are still there and work basically the same way, matching up buyers and sellers, and taking a 1% commission from each. They will store your gold free or ship it to you (now $10 plus shipping instead of $5 plus shipping). I’m not sure how big the Nucleo market is and I think a lot of the pending orders you see are actually generated by Nucleo. You can buy bars of different weights or coins issued by countries. I like the idea of coins because they are easy to identify and harder to fake than a bar. The US, Canada, UK, Australia, Austria, South Africa, and China all issue gold coins as well as silver and sometimes platinum (platinum isn’t that much more expensive than gold right now). The US coin, the American Eagle, is a tougher alloy instead of pure gold, but now the US makes the American Buffalo (looks like a big gold buffalo nickel) which is pure gold. These coins cost a little more than the “spot price” of gold by the ounce. There are collectible proof versions that cost even more, but proofs are specifically manufactured to be shinier.

Gold has gone way up from when I wrote about it. Back then it was $400 an ounce, which seemed crazy. Now it is $1326 per ounce which seems completely ridiculous, except that it was $1900 an ounce in 2011. I should have bought gold when I first wrote about it. At Nucleo, the Canadian, South African, and Austrian gold coins were going for an asking price of about $1362 per ounce right now. The American Eagle is a little higher at $1372, for probably no other reason than people in America probably prefer American coins. If I were to buy a coin at $1372, then pay a 1% commission, then $10 for handling and maybe another $10 for shipping, an American Eagle would cost $1405. Maybe I could get one for a little less (the current bid price is only $1355, so there can be a pretty big spread between buyers’ bid price and sellers’ asking price). I found two other websites that seem reputable called APMEX and JM Bullion. APMEX charges $15 for shipping (free for orders over $5,000). JM Bullion will ship you the gold for free (included in the price; you get a better price if you buy more coins), but their nominal cost is higher than Nucleo, $1380 for a random year coin when I was looking. If you want a 2014 coin you have to pay $1387. Since this is my first coin, I felt like getting an American Eagle in the current year would be worth the extra few dollars. The Eagles look nice too, with a walking liberty on one side and a flying eagle on the other (UK, Canada, Australia, and New Zealand all have pictures of Queen Elizabeth, no thanks; the Austrian coin commemorates the Austria Philharmonic and is probably the best looking of any). Some people use eBay, but that seems risky and inefficient due to eBay and PayPal fees. The other thing you could do is find a local store and buy gold there. Gold is exempt from sales tax, which is nice, but a real store might not have great prices due to overhead, though you might be able to get a nice coin without many scratches since you can see what you are buying. Some of these coins could be 20 years old and condition isn’t as important as the content (sort of; if you want a premium over the scrap price of gold, your coin needs to be in good shape).

I figured I would buy one coin and see how it goes. If the price drops (the price dropped 25% in 2013), then I could buy more, or maybe buy a gold ETF instead of physical gold. There is even a silver ETF called SLV (down 40% in 2013!). The people getting ready for the apocalypse prefer silver because it is hard to make change for gold coins, but with the price of gold at 66 times the price of silver, you have to get a lot of silver and its price is more erratic than gold (which is already very erratic), plus the cost premium of a Silver Eagle coin is about $3 over the spot price whereas it might be $60 for a Gold Eagle coin, but for 66 silver coins, you are paying a $198 premium for the same amount of money invested as one gold coin. I doubt it will be a good investment, but at least I can look at it. I won’t get the coin for a while. I have to mail a check (they don’t do bank transfers and charge extra for credit card transactions), wait 5 days for it to clear, and then wait on the mail. It could be a few weeks. At that point the price could have changed significantly, but the price was locked in once I placed the order.

They sent an email today that they had received the check and deposited it. They said they would wait 5 days for funds to clear (really for the check not to bounce) and would let me know when they ship. Also yeterday I bought a few shares of the silver exchange traded fund, SLV, figuring I don’t care if I own any actual silver. The biggest uses for silver were silverware and photographic film, but I don’t know how much those are needed anymore. Silver’s price is much more volatile than gold’s price, which is pretty volatile. So we’ll see how this goes.

re: “I have to mail a check.”

My favorite part of your investment!

“They were walking their dog when they spotted something shiny on the ground.”

http://www.cnn.com/2014/02/25/us/california-gold-discovery/

I hope your gold coin comes in time for our annual Easter Egg Hunt. If you hide it in one of the plastic eggs, it would be a great honor to your father. 🙂

And a great find for Michael or Fiona! (I’m guessing that Grant really likes that idea!)

I will not be giving away gold coins at Easter. I looked up the value of silver dollars of the Easter egg era, and they seem to be about $12 to $30, though it depends a lot on specific years and condition of the coins.

Right on time after a 5-day waiting period, today I got an email saying a printing label had been made and I would get tracking information in a couple of days. Since I won’t be home to sign for it (don’t know if they will let Eric sign for it, if he is home), once it does arrive, I will have to wait another day for it to be delivered to the local post office, and then can pick it up the following morning.

I got the coin today (Eric signed for it; only registered mail has to be signed by the addressee). It looks like one of those chocolate coins you get, a little smaller than I thought maybe, but it’s pretty thick. It is in great condition. The proofs and uncirculated coins are highly polished and have a “W” on them which stands for the West Point mint. All of the gold coins are made in West Point, but they are not all proofs. Mine has a duller finish and no W.

The latest figures from the US Mint show they made 857,000 1-ounce coins in 2011, but 40 million silver coins. 59,000 pounds of the government’s useless gold that they were able to get rid of. They also have gold coins of 1/2, 1/4, and 1/10 of an ounce. The 1/10 ounce coin is pretty popular at 350,000 coins, but only 80,000 and 70,000 of the 1/4 and 1/2 ounce coins were made.

Because the coins are made to very high tolerances, I figured it would be a good way to test my calipers and scale. The scale is correct to the tenth of a gram (and is correct to the thousandth of a troy ounce). The calipers are correct to a few hundreths of a millimeter, but the reading is affected by how tight you clamp down. The key to accurate readings with calipers is consistent pressure.